-

LexinFintech Holdings Ltd. Reports Third Quarter 2023 Unaudited Financial Results

来源: Nasdaq GlobeNewswire / 22 11月 2023 18:00:45 America/New_York

SHENZHEN, China, Nov. 22, 2023 (GLOBE NEWSWIRE) -- LexinFintech Holdings Ltd. (“Lexin” or the “Company”) (NASDAQ: LX), a leading technology-empowered personal financial service enabler in China, today announced its unaudited financial results for the quarter ended September 30, 2023.

“Lexin reported total loan originations of RMB63.3 billion for the third quarter of 2023, achieving a year-over-year increase of 12.7%. Cumulatively, our growth for the first three quarters stands at 26.7%. The outstanding loan balance reached RMB121 billion, reflecting an increase of 27.7% compared to last year,” said Jay Wenjie Xiao, Chairman and CEO of Lexin. “The consistent delivery of strong quarterly results this year reinforces our confidence in meeting the loan origination target we set earlier. Despite the sluggish macroeconomic recovery and tepid consumer spending, it is noteworthy that we have sustained momentum since the first-quarter trough in 2022.”

“In the past quarter, we continued to focus on our core strategies: enhancing risk management capabilities, attracting higher-quality customer cohorts, refining operations, and implementing cost-effective initiatives. These efforts have yielded in an improved customer base, increased user acquisition efficiency, an optimized funding structure, and a refined portfolio tenure structure.”

“Looking forward, we remain vigilant and are taking all necessary measures to safeguard our asset quality. We continue to be committed to prudently balancing growth with risks and cautiously navigating uncertainties. At the same time, we are pivoting by steadfastly pursuing our strategic goals,” added Mr. Xiao.

“Our financial results for the third quarter were robust, keeping us on a path of recovery and growth,” stated James Zheng, CFO of Lexin. “Total operating revenue was RMB3.5 billion, marking a substantial increase of 30.4% year-over-year and 14.8% quarter-on-quarter. Net profit ascended to RMB371 million, registering a rise of 34.4% over the previous year and 4.2% from the last quarter. The net profit margin edged up to 10.6%, from 10.2% in the third quarter of 2022. This profitability boost springs from the enhanced control over the early repayment behaviors, leading to an improvement in our revenue take rate. Moreover, despite the allocation of additional provisions in line with our prudent approach, factors like reduced funding costs, more effective customer acquisition strategies, a higher-quality customer base, and ongoing implementation of cost-efficiency measures have all played a part in enhancing the profitability this quarter.”

Third Quarter 2023 Operational Highlights:

User Base

- Total number of registered users reached 204 million as of September 30, 2023, representing an increase of 11.3% from 184 million as of September 30, 2022, and users with credit lines reached 41.6 million as of September 30, 2023, up by 5.3% from 39.5 million as of September 30, 2022.

- Number of active users1 who used our loan products in the third quarter of 2023 was 4.9 million, representing a decrease of 13.6% from 5.6 million in the third quarter of 2022.

- Number of cumulative borrowers with successful drawdown was 30.9 million as of September 30, 2023, an increase of 5.8% from 29.2 million as of September 30, 2022.

Loan Facilitation Business

- As of September 30, 2023, we cumulatively originated RMB1,050.7 billion in loans, an increase of 30.1% from RMB807.5 billion a year ago.

- Total loan originations2 in the third quarter of 2023 was RMB63.3 billion, an increase of 12.7% from RMB56.2 billion in the third quarter of 2022.

- Total outstanding principal balance of loans2 reached RMB121 billion as of September 30, 2023, representing an increase of 27.7% from RMB94.6 billion as of September 30, 2022.

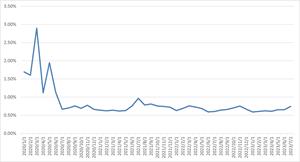

Credit Performance

- 90 day+ delinquency ratio was 2.67% as of September 30, 2023, as compared with 2.59% as of June 30, 2023.

- First payment default rate (30 day+) for new loan originations was below 1% as of September 30, 2023.

Tech-empowerment Service

- For the third quarter of 2023, we served over 90 business customers with our tech-empowerment service.

- In the third quarter of 2023, the business customer retention rate3 of our tech-empowerment service was over 85%.

Installment E-commerce Platform Service

- GMV4 in the third quarter of 2023 for our installment e-commerce platform service was RMB1,381 million, representing an increase of 12.8% from RMB1,224 million in the third quarter of 2022.

- In the third quarter of 2023, our installment e-commerce platform service served over 400,000 users and 400 merchants.

Other Operational Highlights

- The weighted average tenor of loans originated on our platform in the third quarter of 2023 was approximately 13.1 months, as compared with 13.8 months in the third quarter of 2022.

- Repeated borrowers’ contribution5 of loans across our platform for the third quarter of 2023 was 90.1%.

Third Quarter 2023 Financial Highlights:

- Total operating revenue was RMB3,509 million, representing an increase of 30.4% from the third quarter of 2022.

- Credit facilitation service income was RMB2,686 million, representing an increase of 61.2% from the third quarter of 2022. Tech-empowerment service income was RMB454 million, representing a decrease of 9.2% from the third quarter of 2022. Installment e-commerce platform service income was RMB369 million, representing a decrease of 29.6% from the third quarter of 2022.

- Net income attributable to ordinary shareholders of the Company was RMB371 million, representing an increase of 34.5% from the third quarter of 2022. Net income per ADS attributable to ordinary shareholders of the Company was RMB2.20 on a fully diluted basis.

- Adjusted net income attributable to ordinary shareholders of the Company6 was RMB417 million, representing an increase of 26.2% from the third quarter of 2022. Adjusted net income per ADS attributable to ordinary shareholders of the Company6 was RMB2.35 on a fully diluted basis.

__________________________

- Active users refer to, for a specified period, users who made at least one transaction during that period through our platform or through our third-party partners’ platforms using the credit line granted by us.

- Originations of loans and outstanding principal balance represent the origination and outstanding principal balance of both on- and off-balance sheet loans.

- Customer retention rate refers to the number of financial institution customers and partners who repurchase our service in the current quarter as a percentage of the total number of financial institution customers and partners in the preceding quarter.

- GMV refers to the total value of transactions completed for products purchased on our e-commerce and Maiya channel, net of returns.

- Repeated borrowers contribution’ for a given period refers to the principal amount of loans borrowed during that period by borrowers who had previously made at least one successful drawdown as a percentage of the total loan facilitation and origination volume through our platform during that period.

- Adjusted net income attributable to ordinary shareholders of the Company, adjusted net income per ordinary share and per ADS attributable to ordinary shareholders of the Company are non-GAAP financial measures. For more information on non-GAAP financial measures, please see the section of “Use of Non-GAAP Financial Measures Statement” and the tables captioned “Unaudited Reconciliations of GAAP and Non-GAAP Results” set forth at the end of this press release.

Third Quarter 2023 Financial Results:

Operating revenue increased by 30.4% from RMB2,690 million in the third quarter of 2022 to RMB3,509 million in the third quarter of 2023.

Credit facilitation service income increased by 61.2% from RMB1,666 million in the third quarter of 2022 to RMB2,686 million in the third quarter of 2023. The increase was driven by the increases in loan facilitation and servicing fees-credit oriented and guarantee income, partially offset by the decrease in financing income.

Loan facilitation and servicing fees-credit oriented increased by 115% from RMB714 million in the third quarter of 2022 to RMB1,533 million in the third quarter of 2023. The increase was primarily due to the increase in off-balance sheet loans originated under the credit-oriented model, as well as better control over the early repayment behaviors.

Guarantee income increased by 55.8% from RMB410 million in the third quarter of 2022 to RMB639 million in the third quarter of 2023. The increase was primarily driven by the increase in loan originations and the increase of outstanding balances in the off-balance sheet loans funded by certain institutional funding partners, which are accounted for under ASC 460, Guarantees.

Financing income decreased by 5.2% from RMB542 million in the third quarter of 2022 to RMB514 million in the third quarter of 2023. The decrease was primarily due to the decrease in the origination of on-balance sheet loans.

Tech-empowerment service income decreased by 9.2% from RMB500 million in the third quarter of 2022 to RMB454 million in the third quarter of 2023. The decrease was primarily due to the decrease in APR of loans originated, as well as the decrease of loan facilitation volume under the profit-sharing model within tech-empowerment service as compared to the third quarter of 2022.

Installment e-commerce platform service income decreased by 29.6% from RMB525 million in the third quarter of 2022 to RMB369 million in the third quarter of 2023. The decrease was primarily due to the decrease in transaction volume in the third quarter of 2023.

Cost of sales decreased by 32.2% from RMB531 million in the third quarter of 2022 to RMB360 million in the third quarter of 2023, which was consistent with the decrease in installment e-commerce platform service income.

Funding cost decreased by 12.0% from RMB150 million in the third quarter of 2022 to RMB132 million in the third quarter of 2023, which was consistent with the decrease in financing income.

Processing and servicing costs decreased by 5.6% from RMB472 million in the third quarter of 2022 to RMB446 million in the third quarter of 2023. This decrease was primarily due to a decrease in risk management and collection expenses.

Provision for financing receivables was RMB162 million for the third quarter of 2023, as compared to RMB126 million for the third quarter of 2022. The lifetime expected credit losses recognized is estimated based on the most recent performance in relation to the Company's on-balance sheet loans, taking into consideration the forward-looking factors.

Provision for contract assets and receivables was RMB159 million in the third quarter of 2023, as compared to RMB133 million in the third quarter of 2022. The increase was primarily due to the significant increase in loan facilitations and servicing fees in the third quarter of 2023.

Provision for contingent guarantee liabilities was RMB894 million in the third quarter of 2023, as compared to RMB382 million in the third quarter of 2022. The increase was primarily due to the increase in loan origination of the off-balance sheet loans funded by certain institutional funding partners, which are accounted for under ASC 460, Guarantees.

Gross profit increased by 51.2% from RMB897 million in the third quarter of 2022 to RMB1,356 million in the third quarter of 2023.

Sales and marketing expenses decreased by 3.3% from RMB425 million in the third quarter of 2022 to RMB411 million in the third quarter of 2023, primarily as a result of the decrease of salaries and personnel related costs for the sales employees.

Research and development expenses decreased by 9.9% from RMB141 million in the third quarter of 2022 to RMB127 million in the third quarter of 2023, primarily as a result of the Company’s improved efficiency.

General and administrative expenses decreased by 18.1% from RMB104 million in the third quarter of 2022 to RMB85.5 million in the third quarter of 2023, primarily as a result of the Company’s expense control measures.

Change in fair value of financial guarantee derivatives and loans at fair value was a loss of RMB246 million in the third quarter of 2023, as compared to a gain of RMB122 million in the third quarter of 2022. The change in fair value was primarily due to the re-measurement of the expected loss rates and changes in the balances of the underlying outstanding off-balance sheet loans at the balance sheet date, partially offset by the fair value gains realized as a result of the release of guarantee obligation.

Income tax expense increased by 63.0% from RMB70.8 million in the third quarter of 2022 to RMB115 million in the third quarter of 2023. The increase in income tax expense was primarily due to the increase in the income before income tax expense in the third quarter of 2023

Net income increased by 34.4% from RMB276 million in the third quarter of 2022 to RMB371 million in the third quarter of 2023.

Outlook

Based on the Company’s preliminary assessment of the current market conditions and the prudent business approach due to the weak consumption recovery, the company reaffirms the earlier guidance of annual GMV amount of RMB245-255 billion, which represents 20-25% year over year growth.

These estimates reflect the Company's current expectation, which is subject to change.

Conference Call

The Company’s management will host an earnings conference call at 09:00 PM U.S. Eastern time on November 22, 2023 (10:00 AM Beijing/Hong Kong time on November 23, 2023).

Participants who wish to join the conference call should register online at:

https://register.vevent.com/register/BI2c6fa8eac52f4506a481efaf8b7d10f7

Once registration is completed, each participant will receive the dial-in number and a unique access PIN for the conference call.

Participants joining the conference call should dial in at least 10 minutes before the scheduled start time.

A live and archived webcast of the conference call will also be available at the Company's investor relations website at http://ir.lexin.com.

About LexinFintech Holdings Ltd.

We are a leading credit technology-empowered personal financial service enabler. Our mission is to use technology and risk management expertise to make financing more accessible for young generation consumers. We strive to achieve this mission by connecting consumers with financial institutions, where we facilitate through a unique model that includes online and offline channels, installment consumption platform, big data and AI driven credit risk management capabilities, as well as smart user and loan management systems. We also empower financial institutions by providing cutting-edge proprietary technology solutions to meet their needs of financial digital transformation.

For more information, please visit http://ir.lexin.com.

To follow us on Twitter, please go to: https://twitter.com/LexinFintech.

Use of Non-GAAP Financial Measures Statement

In evaluating our business, we consider and use adjusted net income attributable to ordinary shareholders of the Company, non-GAAP EBIT, adjusted net income per ordinary share and per ADS attributable to ordinary shareholders of the Company, four non-GAAP measures, as supplemental measures to review and assess our operating performance. The presentation of the non-GAAP financial measures is not intended to be considered in isolation or as a substitute for the financial information prepared and presented in accordance with U.S. GAAP. We define adjusted net income attributable to ordinary shareholders of the Company as net income attributable to ordinary shareholders of the Company excluding share-based compensation expenses, interest expense associated with convertible notes, and investment (loss)/income and we define non-GAAP EBIT as net income excluding income tax expense, share-based compensation expenses, interest expense, net, and investment (loss)/income.

We present these non-GAAP financial measures because they are used by our management to evaluate our operating performance and formulate business plans. Adjusted net income attributable to ordinary shareholders of the Company enables our management to assess our operating results without considering the impact of share-based compensation expenses, interest expense associated with convertible notes, and investment (loss)/income. Non-GAAP EBIT, on the other hand, enables our management to assess our operating results without considering the impact of income tax expense, share-based compensation expenses, interest expense, net, and investment (loss)/income. We also believe that the use of these non-GAAP financial measures facilitates investors’ assessment of our operating performance. These non-GAAP financial measures are not defined under U.S. GAAP and are not presented in accordance with U.S. GAAP.

These non-GAAP financial measures have limitations as an analytical tool. One of the key limitations of using adjusted net income attributable to ordinary shareholders of the Company and non-GAAP EBIT is that they do not reflect all items of income and expense that affect our operations. Share-based compensation expenses, interest expense associated with convertible notes, income tax expense, interest expense, net, and investment (loss)/income have been and may continue to be incurred in our business and are not reflected in the presentation of adjusted net income attributable to ordinary shareholders of the Company and non-GAAP EBIT. Further, these non-GAAP financial measures may differ from the non-GAAP financial information used by other companies, including peer companies, and therefore their comparability may be limited.

We compensate for these limitations by reconciling each of the non-GAAP financial measures to the most directly comparable U.S. GAAP financial measure, which should be considered when evaluating our performance. We encourage you to review our financial information in its entirety and not rely on a single financial measure.

Exchange Rate Information Statement

This announcement contains translations of certain RMB amounts into U.S. dollars (“US$”) at specified rates solely for the convenience of the reader. Unless otherwise stated, all translations from RMB to US$ were made at the rate of RMB7.2960 to US$1.00, the exchange rate set forth in the H.10 statistical release of the Federal Reserve Board on September 29, 2023. The Company makes no representation that the RMB or US$ amounts referred could be converted into US$ or RMB, as the case may be, at any particular rate or at all.

Safe Harbor Statement

This announcement contains forward-looking statements. These statements are made under the “safe harbor” provisions of the U.S. Private Securities Litigation Reform Act of 1995. Statements that are not historical facts, including statements about Lexin’s beliefs and expectations, are forward-looking statements. These forward-looking statements can be identified by terminology such as “will,” “expects,” “anticipates,” “future,” “intends,” “plans,” “believes,” “estimates,” “confident” and similar statements. Among other things, the expectation of its collection efficiency and delinquency, business outlook and quotations from management in this announcement, contain forward-looking statements. Lexin may also make written or oral forward-looking statements in its periodic reports to the U.S. Securities and Exchange Commission (the “SEC”), in its annual report to shareholders, in press releases and other written materials and in oral statements made by its officers, directors or employees to third parties. Forward-looking statements involve inherent risks and uncertainties. A number of factors could cause actual results to differ materially from those contained in any forward-looking statement, including but not limited to the following: Lexin’s goal and strategies; Lexin’s expansion plans; Lexin’s future business development, financial condition and results of operations; Lexin’s expectation regarding demand for, and market acceptance of, its credit and investment management products; Lexin’s expectations regarding keeping and strengthening its relationship with borrowers, institutional funding partners, merchandise suppliers and other parties it collaborates with; general economic and business conditions; and assumptions underlying or related to any of the foregoing. Further information regarding these and other risks is included in Lexin’s filings with the SEC. All information provided in this press release and in the attachments is as of the date of this press release, and Lexin does not undertake any obligation to update any forward-looking statement, except as required under applicable law.

For investor and media inquiries, please contact:

LexinFintech Holdings Ltd.

IR inquiries:

Mandy Dong

Tel: +86 (755) 3637-8888 ext. 6258

E-mail: Mandydong@lexin.comMedia inquiries:

Limin Chen

Tel: +86 (755) 3637-8888 ext. 6993

E-mail: liminchen@lexin.comSOURCE LexinFintech Holdings Ltd.

LexinFintech Holdings Ltd.

Unaudited Condensed Consolidated Balance SheetsAs of (In thousands) December 31, 2022 September 30, 2023 RMB RMB US$ ASSETS Current Assets Cash and cash equivalents 1,494,150 2,527,065 346,363 Restricted cash 1,267,512 1,502,659 205,957 Restricted term deposit and short-term investments 1,331,858 804,439 110,258 Short-term financing receivables, net(1)(2) 6,397,920 4,295,020 588,681 Short-term contract assets and receivables, net(1)(2) 3,894,175 5,531,882 758,208 Deposits to insurance companies and guarantee companies 2,249,022 2,406,041 329,775 Prepayments and other current assets(2) 1,086,952 1,447,589 198,409 Amounts due from related parties 6,602 7,143 979 Inventories, net 53,917 57,284 7,851 Total Current Assets 17,782,108 18,579,122 2,546,481 Non-current Assets Restricted cash 168,521 144,728 19,837 Long-term financing receivables, net(1) 460,325 302,201 41,420 Long-term contract assets and receivables, net(1)(2) 605,051 682,044 93,482 Property, equipment and software, net 284,593 428,024 58,666 Land use rights, net 931,667 905,867 124,159 Long‑term investments 348,376 348,065 47,706 Deferred tax assets 1,141,761 1,155,109 158,321 Other assets 1,048,301 1,162,690 159,360 Total Non-current Assets 4,988,595 5,128,728 702,951 TOTAL ASSETS 22,770,703 23,707,850 3,249,432 LIABILITIES Current liabilities Accounts payable 25,970 14,533 1,992 Amounts due to related parties 4,669 2,521 346 Short‑term borrowings 1,168,046 814,923 111,694 Short‑term funding debts 4,385,253 3,726,246 510,725 Deferred guarantee income 894,858 1,477,746 202,542 Contingent guarantee liabilities 882,107 1,630,413 223,467 Accruals and other current liabilities(2) 3,057,469 4,044,360 554,326 Convertible notes 2,063,545 905,676 124,133 Total Current Liabilities 12,481,917 12,616,418 1,729,225 Non-current Liabilities Long-term borrowings 150,430 524,270 71,857 Long‑term funding debts 1,334,105 676,076 92,664 Deferred tax liabilities 52,559 68,140 9,339 Other long-term liabilities 102,941 51,043 6,996 Total Non-current Liabilities 1,640,035 1,319,529 180,856 TOTAL LIABILITIES 14,121,952 13,935,947 1,910,081 Shareholders’ equity: Class A Ordinary Shares 191 192 29 Class B Ordinary Shares 47 47 8 Treasury stock (328,764 ) (328,764 ) (45,061 ) Additional paid-in capital 3,081,254 3,171,101 434,631 Statutory reserves 1,022,592 1,022,592 140,158 Accumulated other comprehensive income (20,842 ) (41,386 ) (5,672 ) Retained earnings 4,894,273 5,948,121 815,258 Total shareholders’ equity 8,648,751 9,771,903 1,339,351 TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY 22,770,703 23,707,850 3,249,432 __________________________

(1) Short-term financing receivables, net of allowance for credit losses of RMB184,187 and RMB72,468 as of December 31, 2022 and September 30, 2023, respectively. Short-term contract assets and receivables, net of allowance for credit losses of RMB216,850 and RMB361,581 as of December 31, 2022 and September 30, 2023, respectively. Long-term financing receivables, net of allowance for credit losses of RMB13,220 and RMB1,645 as of December 31, 2022 and September 30, 2023, respectively. Long-term contract assets and receivables, net of allowance for credit losses of RMB52,742 and RMB73,130 as of December 31, 2022 and September 30, 2023, respectively. (2) Starting from the fourth quarter of 2022, we updated the presentation of our Condensed Consolidated Balance Sheets, to provide more relevant and clear information. We also revised the presentation in comparative periods to conform to the current classification. Accrued interest receivable is included in Short-term financing receivables. Guarantee receivables and Contract assets and service fees receivable are combined as Contract assets and receivables. Prepaid expenses and other current assets and Loan at fair value are combined as Prepayments and other current assets. Accrued interest payable and Accrued expenses and other current liabilities are combined as Accruals and other current liabilities.

LexinFintech Holdings Ltd.

Unaudited Condensed Consolidated Statements of OperationsFor the Three Months Ended

September 30,For the Nine Months Ended

September 30,(In thousands, except for share and per share data) 2022 2023 2022 2023 RMB RMB US$ RMB RMB US$ Operating revenue: Credit facilitation service income(3) 1,665,652 2,685,574 368,089 4,000,300 6,939,100 951,083 Loan facilitation and servicing fees-credit oriented 714,102 1,533,203 210,143 1,637,287 3,443,293 471,943 Guarantee income 409,842 638,595 87,527 953,518 1,809,862 248,062 Financing income(3) 541,708 513,776 70,419 1,409,495 1,685,945 231,078 Tech-empowerment service income(3) 499,699 453,944 62,218 1,433,174 1,213,571 166,334 Installment e-commerce platform service income(3) 524,986 369,417 50,633 1,382,071 1,394,975 191,197 Total operating revenue 2,690,337 3,508,935 480,940 6,815,545 9,547,646 1,308,614 Operating cost Cost of sales (530,685 ) (359,683 ) (49,299 ) (1,410,265 ) (1,291,547 ) (177,021 ) Funding cost (149,545 ) (131,640 ) (18,043 ) (371,694 ) (437,674 ) (59,988 ) Processing and servicing cost (472,261 ) (445,845 ) (61,108 ) (1,408,357 ) (1,420,946 ) (194,757 ) Provision for financing receivables (126,214 ) (161,807 ) (22,177 ) (290,962 ) (446,586 ) (61,210 ) Provision for contract assets and receivables (132,678 ) (159,443 ) (21,853 ) (333,896 ) (426,631 ) (58,475 ) Provision for contingent guarantee liabilities (381,697 ) (894,174 ) (122,557 ) (1,009,013 ) (2,269,269 ) (311,029 ) Total operating cost (1,793,080 ) (2,152,592 ) (295,037 ) (4,824,187 ) (6,292,653 ) (862,480 ) Gross profit 897,257 1,356,343 185,903 1,991,358 3,254,993 446,134 Operating expenses: Sales and marketing expenses (424,544 ) (410,651 ) (56,284 ) (1,262,441 ) (1,303,728 ) (178,691 ) Research and development expenses (140,560 ) (126,582 ) (17,350 ) (447,595 ) (377,447 ) (51,733 ) General and administrative expenses (104,389 ) (85,526 ) (11,722 ) (334,513 ) (279,082 ) (38,251 ) Total operating expenses (669,493 ) (622,759 ) (85,356 ) (2,044,549 ) (1,960,257 ) (268,675 ) Change in fair value of financial guarantee derivatives and loans at fair value 121,776 (245,568 ) (33,658 ) 689,196 41,158 5,641 Interest expense, net (16,202 ) (14,354 ) (1,967 ) (47,449 ) (40,238 ) (5,515 ) Investment (loss)/income (3,027 ) (568 ) (78 ) 4,479 (1,107 ) (152 ) Others, net 16,210 13,010 1,783 61,929 29,866 4,093 Income before income tax expense 346,521 486,104 66,627 654,964 1,324,415 181,526 Income tax expense (70,828 ) (115,479 ) (15,828 ) (130,338 ) (270,567 ) (37,084 ) Net income 275,693 370,625 50,799 524,626 1,053,848 144,442 Less: net income attributable to non-controlling interests 231 - - 6,290 - - Net income attributable to ordinary shareholders of the Company 275,462 370,625 50,799 518,336 1,053,848 144,442 Net income per ordinary share attributable to ordinary shareholders of the Company Basic 0.82 1.13 0.15 1.49 3.21 0.44 Diluted 0.75 1.10 0.15 1.40 3.06 0.42 Net income per ADS attributable to ordinary shareholders of the Company Basic 1.64 2.25 0.31 2.97 6.42 0.88 Diluted 1.51 2.20 0.30 2.81 6.12 0.84 Weighted average ordinary shares outstanding Basic 336,900,544 328,993,585 328,993,585 348,868,793 328,524,266 328,524,266 Diluted 381,524,186 355,221,352 355,221,352 393,605,236 364,767,295 364,767,295 __________________________

(3) Starting from the fourth quarter of 2022, we updated the descriptions of three categories of our revenue streams as Credit facilitation service income, Tech-empowerment service income, and Installment e-commerce platform service income, to provide more relevant and clear information. We also revised the revenue presentation in comparative periods to conform to the current classification. Credit facilitation service income was previously reported as “Credit-Driven Platform Services” before the change of presentation. Financing income was previously reported as “Interest and financial services income and other revenues” before the change of presentation. Tech-empowerment service income was previously reported as “Technology-Driven Platform Services” before the change of presentation. Installment e-commerce platform service income was previously reported as “New consumption-driven, location-based services” before the change of presentation.

LexinFintech Holdings Ltd.

Unaudited Condensed Consolidated Statements of Comprehensive IncomeFor the Three Months Ended September 30, For the Nine Months Ended September 30, (In thousands) 2022 2023 2022 2023 RMB RMB US$ RMB RMB US$ Net income 275,693 370,625 50,799 524,626 1,053,848 144,442 Other comprehensive income Foreign currency translation adjustment, net of nil tax (25,170 ) 38 5 (44,777 ) (20,544 ) (2,816 ) Total comprehensive income 250,523 370,663 50,804 479,849 1,033,304 141,626 Less: net income attributable to non-controlling interests 231 - - 6,290 - - Total comprehensive income attributable to ordinary shareholders of the Company 250,292 370,663 50,804 473,559 1,033,304 141,626

LexinFintech Holdings Ltd.

Unaudited Reconciliations of GAAP and Non-GAAP ResultsFor the Three Months Ended

September 30,For the Nine Months Ended

September 30,(In thousands, except for share and per share data) 2022 2023 2022 2023 RMB RMB US$ RMB RMB US$ Reconciliation of Adjusted net income attributable to ordinary shareholders of the Company to Net income attributable to ordinary shareholders of the Company Net income attributable to ordinary shareholders of the Company 275,462 370,625 50,799 518,336 1,053,848 144,442 Add: Share-based compensation expenses 39,963 26,237 3,596 119,781 84,893 11,636 Interest expense associated with convertible notes 12,044 19,791 2,713 34,454 61,864 8,479 Investment loss/(income) 3,027 568 78 (4,479 ) 1,107 152 Adjusted net income attributable to ordinary shareholders of the Company 330,496 417,221 57,186 668,092 1,201,712 164,709 Adjusted net income per ordinary share attributable to ordinary shareholders of the Company Basic 0.98 1.27 0.17 1.92 3.66 0.50 Diluted 0.87 1.17 0.16 1.70 3.29 0.45 Adjusted net income per ADS attributable to ordinary shareholders of the Company Basic 1.96 2.54 0.35 3.83 7.32 1.00 Diluted 1.73 2.35 0.32 3.39 6.59 0.90 Weighted average number of ordinary shares outstanding attributable to ordinary shareholders of the Company Basic 336,900,544 328,993,585 328,993,585 348,868,793 328,524,266 328,524,266 Diluted 381,524,186 355,221,352 355,221,352 393,605,236 364,767,295 364,767,295 Reconciliations of Non-GAAP EBIT to Net income Net income 275,693 370,625 50,799 524,626 1,053,848 144,442 Add: Income tax expense 70,828 115,479 15,828 130,338 270,567 37,084 Share-based compensation expenses 39,963 26,237 3,596 119,781 84,893 11,636 Interest expense, net 16,202 14,354 1,967 47,449 40,238 5,515 Investment loss/(income) 3,027 568 78 (4,479 ) 1,107 152 Non-GAAP EBIT 405,713 527,263 72,268 817,715 1,450,653 198,829 Additional Credit Information

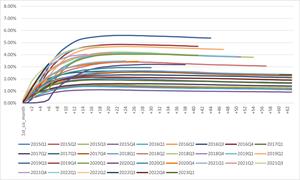

Vintage Charge Off Curve

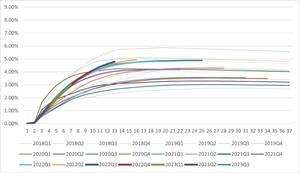

Dpd30+/GMV by Performance Windows

First Payment Default 30+